TEACHING CHILDREN ABOUT

MANAGING MONEY

“We teach children to save their money. As an attempt to counteract thoughtless and selfish expenditure, this is a value. But it is not positive; it does not lead the child into the safe and useful avenues of self-expression or self-expenditure. To teach a child to invest and use is better than to teach him to save.” – Henry Ford

“With the amount of money I have, it’s difficult raising children the way I was raised.”– Adam Sandler

Discussing Money With Children

While Ford and Sandler, one a Depression-era industrialist and the other a modern-day comedian, have life stories that couldn’t appear to be more different, their quotes about children and money reveal a common struggle. Whether a family is preparing to discuss its estate plan with the next generation or introducing a child to her first piggy bank, discussing money and the responsibility for it has long been one of the more difficult conversations parents can have with their children.

Let’s review some important dimensions of wealth and responsibility and the strategies parents can use to teach kids of any age, from early childhood to early adulthood, about managing money.

Pass the Wealth…and the Values

During the financial planning process, a considerable amount of time can be spent on estate planning and ensuring that wealth is passed to the next generation in the most tax efficient manner possible. When discussing the subject of wealth transfer with parents and grandparents, the greater concern in passing wealth to the next generation is not avoiding unnecessary taxation, but rather preserving the next generation’s work ethic and teaching them to embrace the responsibility of wealth by maintaining charitable giving and community service as core values.

In 2018, U.S. Trust conducted an annual survey, Insights on Wealth and Worth®, which examined wealth management challenges confronting high- net-worth individuals in the United States. The survey included 640 individuals with at least $3 million in investable assets. The findings from this survey indicate that while six in 10 wealthy parents say it is important to leave an inheritance to the next generation, only one in five agree strongly that their children will be able to handle the wealth they receive, and fewer than one in three have discussed details of an inheritance with their children. In fact, only a third of wealthy parents have fully disclosed their wealth to their children, while just under half have disclosed only a little.

The primary reasons for not discussing family wealth are concerns about negative repercussions on work ethic and family privacy and the fact that they were taught to never discuss wealth. Nearly 20% of parents with children over the age of 25 haven’t discussed family wealth because they think their children aren’t old enough or mature enough.

Be Open With Children About Money

It may seem like a simple answer, but the best way to educate children about money is to talk to them about how you make financial decisions. Discuss your perspective on spending and saving with them.

Reasons Parents Have Not Fully Disclosed Level of Wealth¹

- Fear children won’t be motivated or productive Consider level of wealth a private matter

- Concern children won’t know how to manage inherited wealth

- Desire for children to live “normal” lives

- Want children to find success in their own right

Keep the Conversation Going

Make sure it’s not a “one and done” conversation. Continue to talk to your children as they grow into teenagers about the outcomes of the financial decisions you’ve made and what you learned from them. And as with all lessons, children learn by example, so they will observe how you manage savings and debt.

Milestones = Opportunities

Start Early With the Piggy Bank

With those things in mind, there is no question that different developmental milestones present opportunities to connect with a child in ways that are meaningful and lasting.

For parents just beginning to talk to a youngster about financial matters, a piggy bank is an ideal way to introduce the concepts of money and savings. Beyond teaching children about the different types of money, be it coins or bills, the piggy bank can also demonstrate the importance of putting money in the appropriate place. This is often the starting point for children to learn how to treat money responsibly.

Managing an allowance is another way. Many parents provide an allowance as payment for chores or as a reward of some kind; others provide it without attaching specific requirements. A child is ready to receive an allowance if he or she can count small sums of money, demonstrates an interest in it and understands the concept of saving. There is no single correct philosophy— what matters most is creating a learning experience.

From Piggy Bank to Community Bank

A child in elementary school may be ready for the next step: a savings account. Many banks still offer the traditional savings account that allows children to record their balance and transaction history in their own passbook.

A savings account can be a good and versatile tool, for several reasons. First, it can be useful in teaching children about the transactional aspects of saving and the power of compounding interest. What’s more, a trip to the bank is a great opportunity to reinforce the importance of saving. It’s also a chance for kids to hone existing skills, such as math and learn some new ones, such as interacting with the teller and completing necessary forms. These types of experiences can help a child develop a sense of ownership in the savings process — and a sense of pride and accomplishment in their ability to manage it well.

Setting the Right Example: Giving Back

Charitable giving and community service are also important lessons that can be taught early. Children remember what they see and live, so although talking to them is a good beginning, including them in actual community service helps them to learn firsthand about philanthropy — what it is and how

it works. Whether it’s volunteering to read at nursing homes or collecting cans for a food drive, the direct experience of serving those in need is a powerful way to teach children. It’s also an indelible lesson that will likely make a significant impact on their future financial decisions.

Parents, Know Your Students

In their nonfiction bestseller, “Freakonomics” (2005), economists and authors Steven D. Levitt and Stephen Dubner look at a collective of unusual facts and explore the hidden economics behind them to understand the human behavior within them. In the movie adaptation, Steven D. Levitt tells a story about his daughter that serves as both humorous anecdote and cautionary tale for parents attempting to teach young kids about matters of finance.

Economist Steven D. Levitt wants to say one very important thing to parents who are just starting to talk to their kids about money: never underestimate a young child’s capacity to grasp economic ideas. It’s fairly common for children as young as three years old to have the ability to understand the concepts of earning, bartering and saving.

In the film Freakonomics (2010), Levitt describes an incentive he devised to introduce his daughter, Amanda, to toilet training. In exchange for using the toilet, Amanda would receive a handful of her favorite candy, M&Ms. In the beginning, the strategy worked well. But after only three days, Amanda had figured out a way to use the incentive to her advantage.

The three-year-old, who just days before had expressed no interest in using the toilet, began going every five minutes as a way to maximize her reward… and her M&M stash. While Levitt muses at the thought of a three-year-old gaming an economist’s incentive strategy, it serves as a good example, and a fair warning to parents about a child’s innate ability to understand how certain behaviors can lead to perks.

Three Envelopes…Budgets Explained

Once children step through the doors of middle school, it’s important to start discussing budgets, savings goals and some of the more detailed aspects of the family finances. The Three Envelopes strategy can be an effective way to help young people think about expenses that have different time horizons attached to them. For many, compartmentalizing money can be the easiest way to organize their finances. Each envelope can be funded by the parent alone or in partnership with the child using money earned from an allowance or job. The purpose of this approach is simply to learn how to make good decisions and correctly allocate money based on the immediacy of the need:

- Envelope One: Immediate expenses, such as lunch money, gas money or entertainment

- Envelope Two: Short-term goals, such as buying a laptop or going on a senior trip. Charitable giving also belongs in this category

- Envelope Three: Longer-term goals, such as buying a car or saving for college

The Three Envelopes strategy can also open the door to larger discussions about the family’s finances. Now that children are being asked to allocate money based on their own anticipated spending, a parent can begin showing how the family allocates money each month for utilities, groceries and other immediate expenses.

To further demostrate these concepts, parents can give their child a grocery list and instructions to buy items on the list without spending more than the allotted amount to teach the child how to stick to a budget. Exercises like this can help a child understand a parent’s rationale for making certain household purchases. It also prepares children to manage similar tasks on their own.

Now the Real Fun Begins…

Investing

Once a child has graduated from the school of savings, he or she is ready for the next stage: investing in stocks or mutual funds, which helps young people learn how investments perform and how businesses function. Investing in special types of accounts designed to fund retirement or college are good first choices.

Roth IRAs

One of the popular ways to get children started in investing is to open a Roth IRA account in their name. A Roth is a popular investment account for kids because of the advantage it provides in being able to grow assets in a tax-free account and because the account is funded with after-tax dollars, withdrawals from the account are made tax free, as well. Additionally, principal amounts may be withdrawn from the account before the account owner turns age 59½. After the account has been open for five years, the child would even be able to withdraw funds from principal contributions for non-retirement purposes, such as educational funding or for a down payment on a first home.

To understand the potential power of investing in a Roth IRA, consider the following hypothetical investment scenario in which a 15-year-old child makes $1,000 working a summer job. Assuming he or she contributes the full $1,000 into a Roth IRA, makes no further contributions, and invests in an equity mutual fund with an 8% average annual rate of return, that original investment would grow to $46,900 by the time the account owner turns 65. And, if that same child contributes $1,000 each summer until they turn 20 years old, assuming the same 8% average annual rate of return, he or she will have an account balance of nearly $250,000 when they turn 65. In addition, a Roth IRA does not have a required minimum distribution. He or she will also have the option to pass these funds to children or grandchildren.

Finally, by giving children exposure to investing through retirement accounts, such as a Roth IRA, they become familiar with both concepts — investing and retirement planning — and may be more likely to adopt an employer-sponsored retirement plan once they start working.

529 Savings Plans

Another way to engage children in investing is to include them in the planning and funding of their own higher education. The 529 college savings plan has become popular because it’s accessible, easy-to-understand, widely available and has attractive features.

Anyone can contribute to a 529 account, regardless of who owns it. That means that a friend, aunt or grandparent can add to a child’s account at any time. Contributions for holidays and birthdays make great gifts. These investments can grow tax free, and money intended for educational purposes can be withdrawn tax free.

Beyond teaching the child how to make investments and plan for college costs, these accounts also give parents the opportunity to talk with kids about other types of college funding, including grants, loans and scholarships. These discussions help parents and children reach a clear understanding of how college will be financed.

On Their Own: Sticking to a Budget

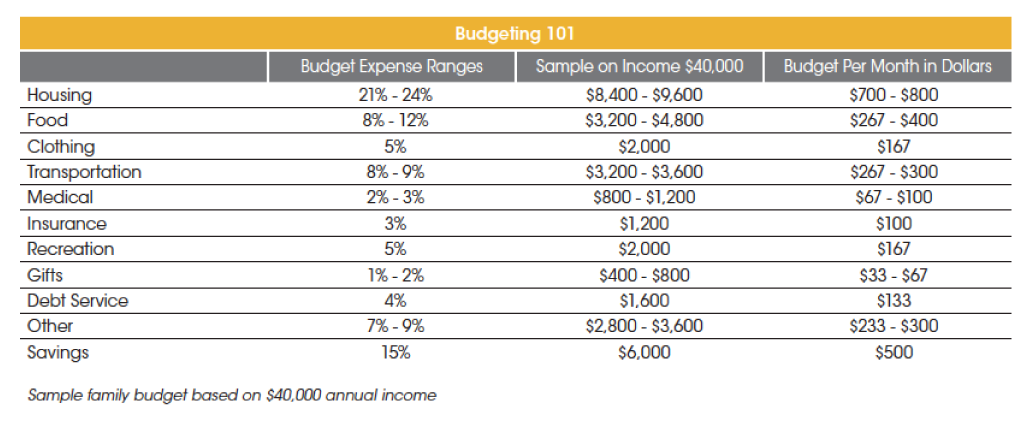

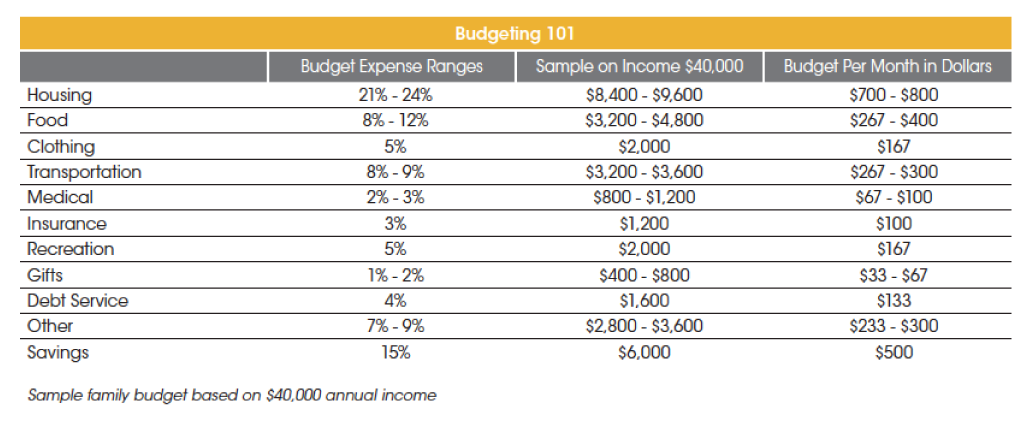

Once children are living on their own, a parent’s best hope is that the money management lessons have taken hold. Reinforcing those lessons with continued emphasis on strategies such as the Three Envelopes makes good sense. Refining them with a detailed, real-life budget is even better. Although many people who struggle with finances cringe at the thought of setting a budget for themselves, it’s necessary to get a clear picture of their personal spending versus income.

The sample budget below shows common expenditures based on a household income of $40,000. While it’s important to create a monthly budget that reflects the specific needs of that household, this example provides guidelines of allocations for each item.

Teach With Technology

From an early age, children are on tablets and computers playing games and learning through technology. To meet them where they are, consider using one of many apps designed to teach children of various ages lessons about money management.

For example, an app for a younger child can teach the basics including setting savings goals, making savings contributions and then setting a time frame for how long it will take to reach a goal, such as to buy a new bike.

Apps for older kids offer more advanced lessons, such as using a pre-paid debit card attached to a bank account set up by parents to learn about spending.

The Need for Financial Literacy

Trends in the United States show that financial literacy among individuals is declining.²

Teaching personal finance in schools is critical to raising high functioning adults. The lack of financial literacy skills can lead to poor spending choices, increased debt and a generational wealth gap.

Learning to be financially literate has immediate results and also helps individuals over the long term to be responsible with the money they earn.

While schools can teach financial literacy, there’s no replacement for what your children can learn at home from their parents and grandparents.

Reach Out With Questions

If you have any questions about teaching children how to responsibly manage money, or if you want further information about strategies that can be used as learning opportunities, please contact your wealth advisor.

Sources:

¹”What to Tell Your Children About Their Inheritance”

This article is intended for informational and educational purposes only. The views expressed do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personalized advice or a recommendation to engage in a particular strategy. Information contained herein has been obtained from sources believed to be reliable, but we do not warrant the accuracy of the information.

The hypothetical examples are provided for illustrative purposes and are not intended to be representative of actual results or any specific investment, which will fluctuate in value. The determinations made by the examples are not guarantees, and no taxes, fees or expenses are included in the calculations, which would reduce the figures shown. Please keep in mind that actual results will vary and investing involves risk and the potential to lose principal.

Investors should consider the investment objectives, risks, charges, and expenses associated with 529 plans before investing. More

information about specific 529 plans is available in each issuer’s official statement, which should be read carefully before investing.

Mariner Advisor Network is a brand utilized by Mariner Independent Advisor Network (“MIAN”) and Mariner Platform Solutions (“MPS”). Investment advisory services are offered through Investment Adviser Representatives registered with MIAN or MPS, each an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. MIAN and MPS comply with the current notice filing requirements imposed upon registered investment advisers by those states where they transact business and maintain clients. MIAN and MPS have either filed notice or qualify for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MIAN or MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For information about which firm your advisor is registered with, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided by your advisor.

Investment Adviser Representatives are independent contractors of MPS or MIAN and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or

affiliated MPS or MIAN and is not registered with the SEC. Please refer to the disclosure statement of MPS or MIAN for additional information.

© Mariner Platform Solutions. All Rights Reserve