Tax and the Presidential Election

As the 2024 presidential election approaches, one thing is clear: whoever takes office will likely face a critical decision regarding significant changes to the tax code set to take effect at the end of 2025. And those changes, or lack of them, can affect each one of us in one way or another.

The expiration of key provisions from the Tax Cuts and Jobs Act (TCJA) of 2017 presents the incoming administration with the choice to address these changes, modify them, or allow them to sunset as scheduled.

This decision could have far-reaching implications for both individual taxpayers and businesses across the nation.

What May Sunset If No Changes Are Made:

-

- The estate tax exemption may decrease significantly, from around $13.61 million per individual (2024 estimate) to approximately $6.8 million per individual in 2026, adjusted for inflation.

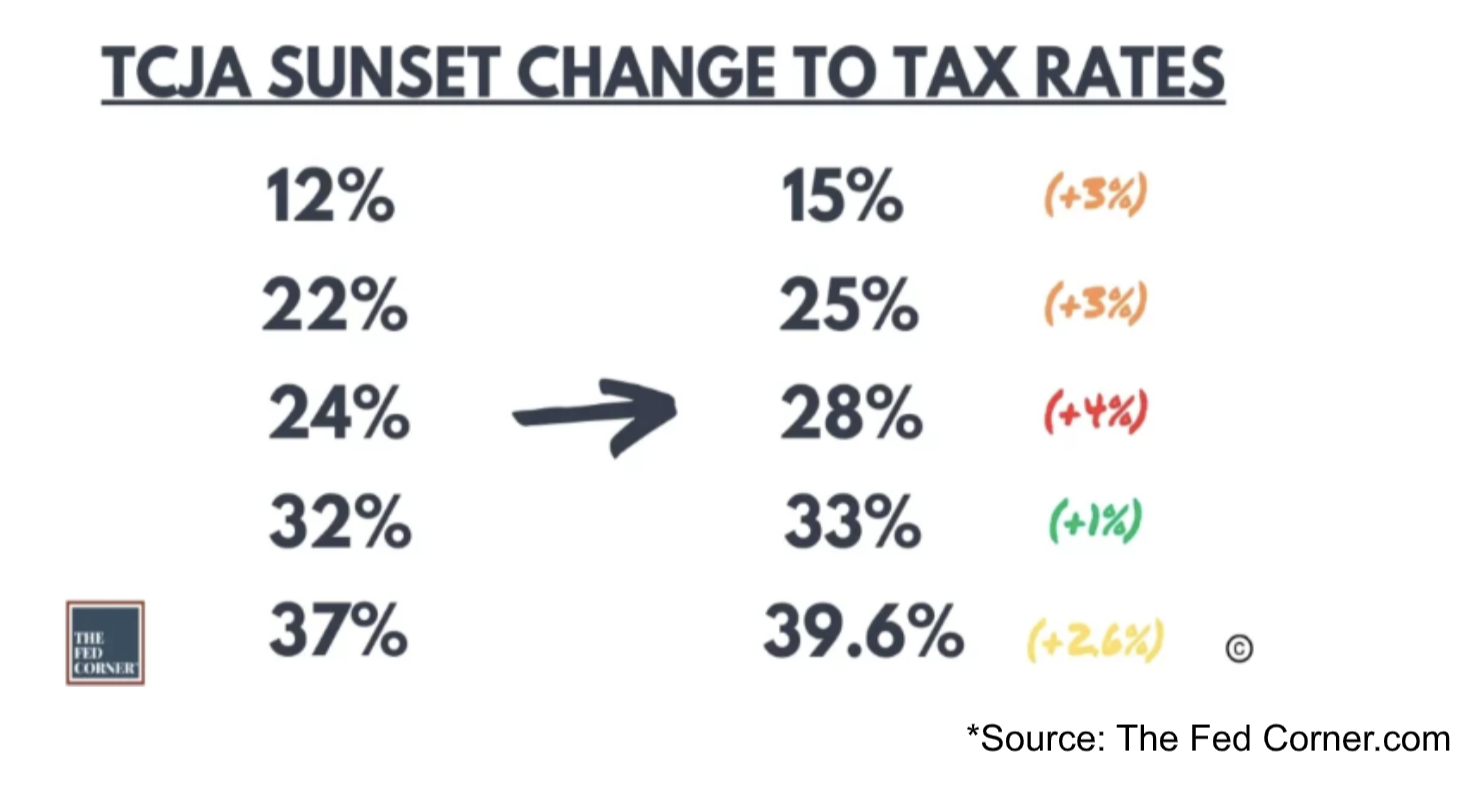

- Individual income tax rates will likely increase for most brackets, with the highest rate rising from 37% to 39.6%.

What Will Likely Remain If No Changes Are Made:

-

- The corporate tax rate is likely to stay at the flat 21% established by the TCJA.

These changes can affect tax burdens for many individuals and businesses, with potentially significant impacts on estate planning and wealth transfer. The reduction in the estate tax exemption could increase taxes due on inheritances for high-net-worth individuals. This change may necessitate revisiting estate plans and considering strategies to mitigate increased estate tax liability. Additionally, other changes to individual tax rates and deductions could affect overall tax planning strategies for both your income and inter-generational

wealth transfer goals.

Whatever the outcome, we are raising awareness with clients that significant changes may be coming down the road. Being educated, thoughtfully planning, and working with an advisor that can help you coordinate your tax strategy with your estate planning could be critical.

Call us at KinneyMunro Wealth Advisors. We can help.

This material is for educational purposes only and is not intended to provide specific advice. Investment Advisory Services are offered through Mariner Platform Solutions (MPS), a SEC Registered Investment Adviser. MPS does not provide legal or tax advice.